North Carolina

Our mission is to save lives by meeting the most critical needs of our communities and investing in breakthrough research to prevent and cure breast cancer.

North Carolina

Our mission is to save lives by meeting the most critical needs of our communities and investing in breakthrough research to prevent and cure breast cancer.

Need Help?

Call our breast care helpline to assist with finding local screening and diagnostic facilities or clinical research trials, requesting financial assistance, or other questions or care needs.

Get Involved

Help us reach our vision of a world without breast cancer by getting involved in our local community.

Make a Difference by Volunteering

When you volunteer with Susan G. Komen, you’re helping to save the lives of people in your community – and around the world. Join us as we work to create a world without breast cancer. We value all our volunteers who assist in Komen events, delivering our mission, sharing our advocacy, and more.

Contact Amy to Get Involved!

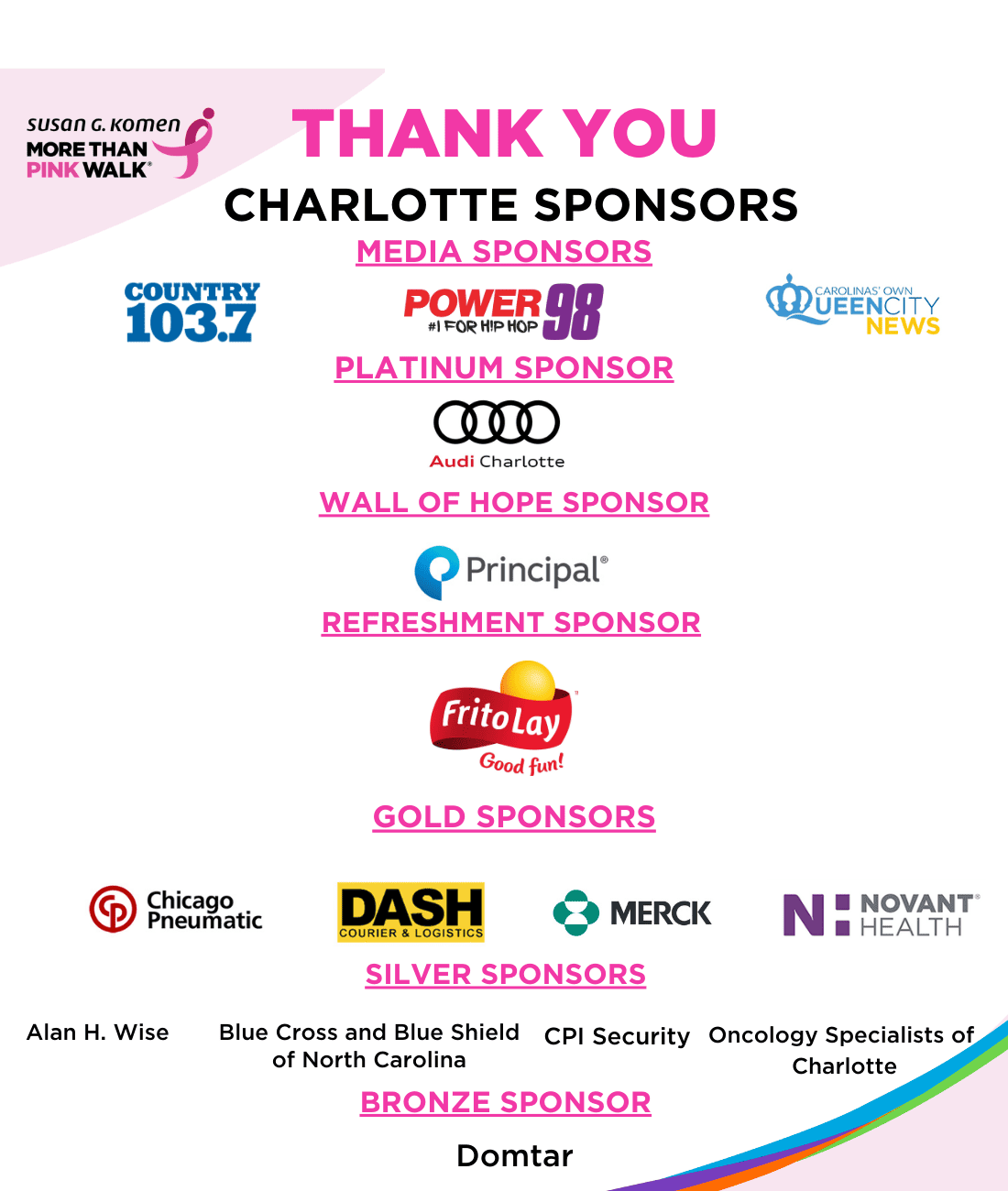

Thank you Sponsors

Help us give a special THANK YOU to our Local More Than Pink Walk Sponsors who are making a big impact in our fight against breast cancer. Let’s support the generous organizations and businesses that support our community!

| Audi Charlotte | Novant Health |

| Principal | Country 103.7 |

| Frito Lay | Queen City News |

| Chicago Pneumatic | Power 98 |

| DASH Courier and Logistics | Merck |

| Alan H. Wise | Blue Cross and Blue Shield of North Carolina |

| Oncology Specialists of Charlotte | Domtar |

| CPI Security |

Local Events

Join the fight to end breast cancer by attending an event in North Carolina!

Questions? Contact Us

ShareForCures

Your breast cancer information is as unique as you are. When combined with thousands of other ShareForCures members, you provide scientists with a more diverse set of data to make new discoveries, faster.

Latest News & Information

Ellen’s Story: The Power in a Choice

"Of all times to proactively share your data, this is the time to do it," remarked Ellen Goodwin when she spoke on her choice to participate in Komen’s ShareForCures breast cancer registry.

The post Ellen’s Story: The Power in a Choice appeared first on Susan G. Komen®.

Susan G. Komen® Peoria MORE THAN PINK Walk Raises Funds for Breast Cancer Patient Care Services in Illinois

Susan G. Komen®, the world’s leading breast cancer organization, will hold the Susan G. Komen Peoria MORE THAN PINK Walk on Saturday, May 11, 2024, at Metro Centre. This signature event enables Komen to raise critical funds that provide direct support to breast cancer patients, fund groundbreaking research, empower health equity initiatives nationwide, and advocate […]

The post Susan G. Komen® Peoria MORE THAN PINK Walk Raises Funds for Breast Cancer Patient Care Services in Illinois appeared first on Susan G. Komen®.

North Carolina

Contact Us

Susan G. Komen North Carolina

Executive Director, North & South Carolina: Jenn Briand

Email: jbriand@komen.org

Phone: 919-695-9756